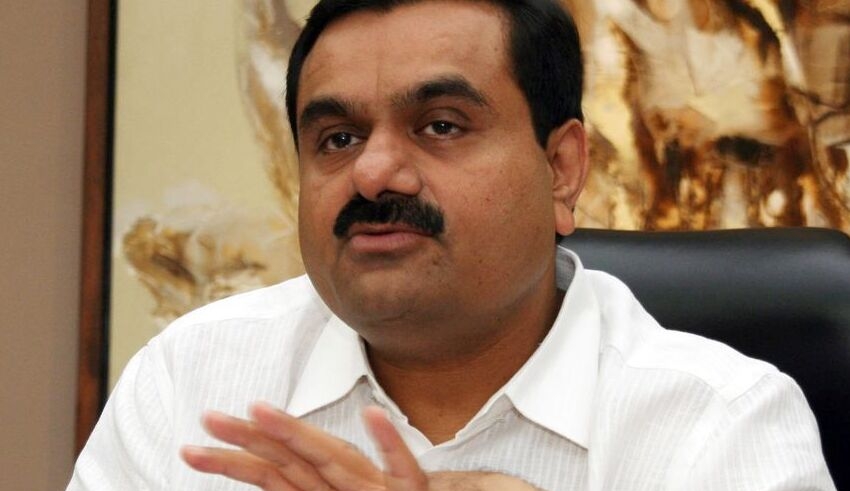

The richest man in Asia is the Indian businessman Gautam Adani, whose business empire includes coal, airports, cement, and media.

He is currently shaken by claims of business malfeasance and a stock market meltdown.

The billionaire began the week as the third-richest person in the world, but has now fallen to seventh place on Forbes’ billionaires tracker after suffering a US$22.6 billion loss in Friday’s trading, bringing his week’s losses to US$45 billion.

Adani is one of the best survivors in the corporate world despite facing arguably the hardest obstacle in his career.

On the first day of the year 1998, Adani and an accomplice were reportedly abducted by gunmen who demanded $1.5 million in ransom before being released at an unknown place.

A decade later, he was dining at the Taj Mahal Palace hotel in Mumbai when militants launched one of India’s worst terror assaults, killing 160 people.

Adani allegedly spent the night hiding in the basement with hundreds of others until being rescued by security forces early the next morning.

Adani, who is now 60 years old, differs from his colleagues among India’s ultra-wealthy, many of whom are known for expensive birthday and wedding parties that are afterwards reported on in newspaper gossip columns.

As a self-described introvert, he maintains a low profile and rarely interacts with the media, delegating business events to lieutenants.

Keep Reading

He told the Financial Times in a 2013 interview, “I’m not a gregarious guy who enjoys attending parties.”

Adani was born into a middle-class family in Ahmedabad, but he left out of school at the age of 16 and travelled to the financial center of Mumbai in search of employment in the lucrative gems sector.

After a brief spell with his brother’s plastics firm, he founded his family’s flagship conglomerate in 1988 by expanding into the export trade.

The contract to develop and run a commercial maritime port in his native state of Gujarat was his big break seven years later.

It rose to become India’s largest port at a period when most ports were controlled by the government – the legacy of a sclerotic economic planning system that stifled progress for decades and was being demolished.

Adani ventured into coal in 2009, a profitable sector for a country whose energy requirements remain almost entirely dependent on fossil fuels. However, the decision garnered international notice as he quickly ascended India’s wealthiest list.

His purchase of an unexplored coal basin the next year spurred years of “Stop Adani” demonstrations in Australia in response to the enormous environmental effect of the project.

Similar concerns beset his coal ventures in the heart of India, when forests inhabited by tribal populations were cleared for mining activities.

The $900 million Adani coastal port project in the southern state of Kerala was the subject of violent skirmishes between police and a local fishing community that demanded a development halt.

But Adani Group’s fast growth into capital-intensive industries has raised red flags, with Fitch subsidiary and market researcher CreditSights saying it was “seriously overleveraged” a year ago.

This week, an explosive study from US investment company Hindenburg Research said that the conglomerate had participated in “deliberate stock manipulation and accounting fraud over decades.”

Hindenburg stated that decades of “government forbearance towards the gang” had made investors, media, people, and politicians “afraid of retaliation” for challenging the group’s activities.

Adani Group’s market capitalization has decreased by more than US$45 billion since the report’s release, and its legal head said on Thursday that the company was considering punitive action against Hindenburg in US and Indian courts.

Gary Dugan, chief executive officer of the Global CIO Office, told Bloomberg on Friday that the problems currently confronting the Adani empire “strike at the heart” of India’s corporate sector and the dominance of family-controlled businesses.

“By their very nature, they are opaque, and worldwide investors must trust corporate governance concerns,” he explained.