(C) New Straits Times

Rather than that, former Inland Revenue Board (IRB) tax officer Syed Nasrul Fahmi Syed Mohamad said that the checks were advanced payments for legal services performed by the lawyer to the previous Prime Minister, based on documents and investigation results.

“Simply stating that it is a loan is wrong and may encourage the public to convert their invoices to loans in order to avoid paying taxes.”

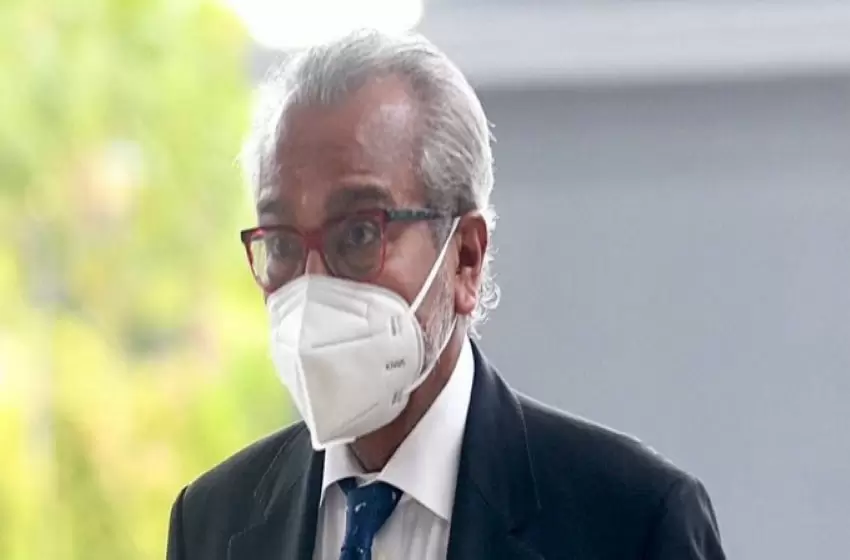

This was said during cross-examination by lawyer Harvinderjit Singh during the trial of Muhammad Shafee, who was accused with collecting RM9.5 million from Najib as profits of criminal operations and filing false tax returns to the IRB.

Earlier, Harvinderjit gave the witness a correspondence between Muhammad Shafee and Najib in which it was indicated that the lawyer’s legal costs would be set only after all election petition cases were resolved.

According to a letter dated September 12, 2013, the RM9.5 million represented Messrs Shafee & Co’s legal expenses in 46 matters including election petitions in which Muhammad Shafee represented Umno and Barisan Nasional (BN).

Additionally, the letter indicated that Muhammad Shafee had urged Najib to provide him a check for RM4.3 million as an advance payment or loan for his immediate use prior to the issuance of the final bill, and then another cheque for RM5.2 million for the same reason.

The two checks totaling RM9.5 million sent into the lawyer’s personal bank account represented the reduced portion of the RM11.5 million in legal costs.

The witness also agreed with Harvinderjit’s statement that if Muhammad Shafee got the RM9.5 million as a loan, it was not required to be recorded as income to the IRB.

Due to the fact that it was not a loan, the witness claimed that the lawyer was judged to have failed to disclose RM9.5 million in revenue to the IRB since it was not included in Form B for the assessment years 2013 and 2014.

“Tan Sri Shafee did not file the form as required by Section 77 (1) of the Income Tax Act (ITA) 1967. The form was filed around nine months after the deadline of June 30, 2014, and he only reported RM3,173,007 in business revenue and paid RM264,720 in tax for the assessment year 2013,” he claimed.

“For the assessment year 2014, he disclosed just RM3,391,108 in business revenue and paid RM319,959 in tax,” he claimed.

On September 13, 2018, Muhammad Shafee entered a not guilty plea to two accusations of obtaining RM9.5 million in profits from illegal operations through two checks issued by former Prime Minister Najib and placed in his CIMB Bank Berhad account.

Additionally, he was charged with two counts of participating in transactions stemming from unlawful acts, namely filing inaccurate tax returns in contravention of paragraph 113 (1) (a) of the Income Tax Act 1967 for the financial years ending December 31, 2013 and December 31, 2014.

Singapore’s leading bus operator SBS Transit plans to start testing its innovative AI-braking system in early 2026. Working with Chinese…

The six attacks by ship sailing in the Singapore strait in five days this month has activated a spate increase…

A great relief for the global nations and the people of both the countries Indian & Pakistan as the massive…

The 2025 spy thriller ‘The Secret Path’ has captured international attention from the day of its premiere in April. This…

K-Pop has been a sensation in both the music and other entertainment industries across the world. Through their vibrant mix…

There are many genres in the web series of South Korean language, but the ‘psychological crime thriller’ will always have…

This website uses cookies.

Read More