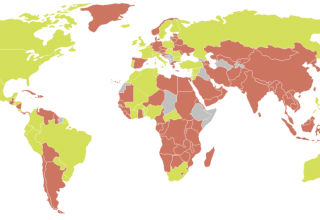

Binance is the biggest cryptocurrency exchange in the world in terms of volume and assets. It executed trades of $9.5 trillion alone in 2021. Yet because bitcoin trading was made illegal in China in 2021, it is not meant to be allowed to function there.

The know-your-customer (KYC) protocols used by the exchange have been hailed by Changpeng “CZ” Zhao, the creator of Binance, as a $1 billion investment. These aim to discourage users from utilizing the platform, especially Chinese users, among other things.

Yet, discussions in Binance’s official Chinese chatrooms show that users often get through the platform’s censors to hide their home or place of origin.

CNBC collected, translated, and analyzed hundreds of communications from a Discord server and a Telegram channel operated and administered by Binance. More than 220,000 people enrolled for these groups, and anyone who joined and registered could read them without charge. Up until the end of March, there were no access limitations, which allowed CNBC to look through texts from 2021 to 2023.

Users posing as Angels or Binance staff members posted the communications that CNBC examined. Throughout these discussions, they discussed ways to get around Binance’s residence, KYC, and verification procedures.

Keep Reading

Some of the strategies that employees and volunteers have talked about involve giving false information, including counterfeit addresses or bank documents.

Also, employees, volunteers, and clients disseminated written materials and video lessons that explained how mainland residents might make up a residence address in order to get a Binance debit card, which would effectively turn their Binance cryptocurrency into a regular checking account.

No matter the strategy, Binance users in China run a huge risk: Since 2017, China has outlawed both cryptocurrency exchanges and the currency itself. Chinese law also forbids access to certain products that Chinese citizens desire.

The strategies employed with and among customers raise additional questions about the efficacy of Binance’s anti-money-laundering operations. Global enterprises like Binance must take KYC and anti-money-laundering measures to make sure that their customers are not engaged in illegal activities like terrorism or fraud.

Concern was expressed by experts in financial regulation on how easily Binance’s KYC and AML procedures may be subverted.

If I had an eight out of 10 concern about Binance from a regulatory position and from a national security perspective, this raises it to a ten out of ten, according to Sultan Meghji, a professor at Duke University and a former top innovation officer for the FDIC, in an interview with CNBC.