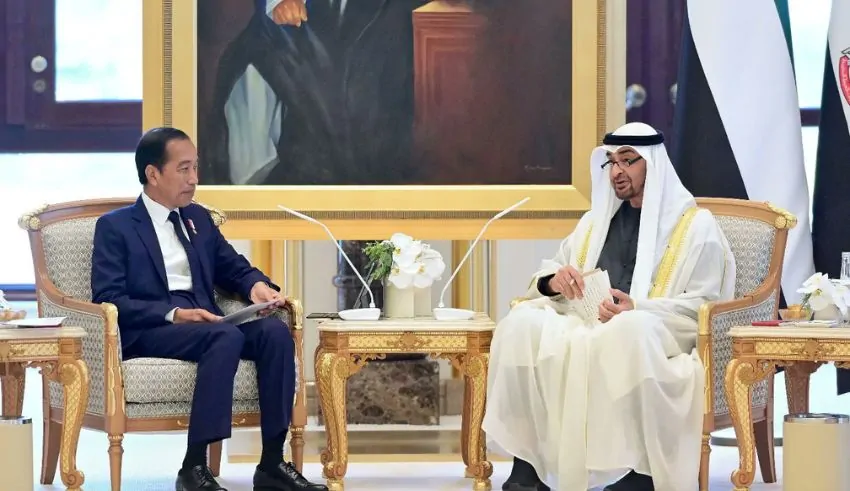

(C) Joko Widodo/X

Formally establishing a partnership to link their different payment systems, the central banks of Indonesia and the United Arab Emirates (UAE) have taken a move targeted at increasing financial cooperation and enhancing economic ties. Underlining the significant alliances Indonesian President Joko “Jokowi” Widodo won during his recent official visit to Abu Dhabi, this arrangement is represented by a memorandum of understanding (MoU). His talks with Emirati President Mohamed bin Zayed Al Nhayan (MBZ) cleared the stage for this significant bilateral commercial turning point.

The major objective of the MoU, claims Bank Indonesia, is to establish a direct link between Indonesia’s systems and those of the UAE. The central banks of both nations anticipate a period whereby trade between the two nations will be open, faster, and more effective. The agreement is aimed to reduce transaction costs, so cross-border payments are more fairly priced for businesses and individuals both. By means of financial exchanges, the two countries wish to increase trade and investment flows between their respective economies, hence improving their economic links.

The MoU also provides the basis for improved good financial practices and security. Bank Indonesia says that the agreement will result in a shared mechanism for managing cross-border payment related risks. This will offer a great degree of security in financial transactions, therefore lowering possible vulnerabilities and protecting the integrity of financial systems of both countries.

One of the primary components of the agreement is stressing regulatory cooperation among the two central banks. Bank Indonesia and the Central Bank of the UAE (CBUAE) have committed to closely ensure that the new payment system link complies with the regulations in every country. By synchronizing their regulatory regimes, the two countries wish to create a fluid and harmonious financial ecosystem that reduces bureaucratic barriers and facilitates better transactions.

Apart from the regulatory cooperation, the MoU stresses the need of defending consumer rights and interests. Promising to uphold present standards safeguarding consumers’ financial information and ensuring fair treatment of them in all transactions, the two central banks’ focus on consumer protection reveals Indonesia’s and the UAE’s desire to maintain the best criteria of financial openness and confidence.

United Arab Emirates’ ambitions for worldwide financial technologies and cross-border payments

From the UAE’s perspective, working with Indonesia is a component of a bigger push to become global dominance in financial technology (fintech). The UAE’s Central Bank (CBUAE) has been aggressively looking for ways to raise the country’s profile in the global financial scene; its new alliance with Indonesia is a main component of this approach. The UAE sees cross-border payment systems as an essential driver of world trade and investment, and this cooperation is a first towards the expansion of the Middle Eastern and beyond financial transaction hubs.

As this MoU with Indonesia maintains increasing status as a fintech pioneer, it matches the UAE’s wider overall objectives of modernizing financial infrastructure and supporting innovation in the payments sector. Rising numbers of fintech businesses based in the United Arab Emirates creating novel concepts for digital currencies, cross-border payments, and other financial technologies. UAE is becoming more visible in Southeast Asia by tying its payment system with Indonesia’s, therefore generating new opportunities for fintech sector collaboration.

This agreement captures the growing economic cooperation between Indonesia and the UAE, not simply in terms of facilitating improved financial transactions. Both countries have been working to strengthen their trade relations while the UAE serves as Indonesia’s key Middle Eastern partner. The new payment system link is expected to provide a strong base for deeper economic integration, therefore enabling trade and investment between businesses across countries.

This alliance with the UAE complements Indonesia’s more ambitious aim of raising its worldwide economic impact. With the largest economy in Southeast Asia, Indonesia is actively seeking to strengthen linkages to world financial markets and create deeper commercial contacts with significant partners. In this sense, the MoU with the UAE signals a strategic pivot since it uses UAE financial technology and cross-border payments to help Indonesia to upgrade its own financial infrastructure, so optimizing its own resources.

Not only does signing this MoU indicate a bilateral success but also sets a benchmark for financial sector regional and global cooperation. As more governments look at methods to mix their payment systems and streamline cross-border transactions, the cooperation between Indonesia and the UAE could serve as a model for other nations attempting to increase financial connectedness. Two central banks cooperating demonstrates the significance of financial integration in fostering stability and economic growth in a society growing daily more linked by nature.

Furthermore, as Indonesia and the United Arab Emirates continuing working to implement this new payment system, there is opportunity for additional cooperation in other fields of financial technology. Both countries have showed a strong commitment to financial sector innovation, therefore this cooperation could open the way for next cooperative projects in fields including digital currencies, blockchain technology, and financial inclusion. By means of continuous strengthening of their financial ties, Indonesia and the UAE can contribute to build a more linked and efficient global financial system.

With the MoU between their central banks, the financial cooperation between the UAE and Indonesia develops much further forward. Through linking their payment systems and supporting additional regulatory cooperation, Indonesia and the UAE are laying the foundation for a future of perfect, safe, and fast cross-border financial transactions. This agreement helps the two countries to be significant players in the evolving scene of world financial technology and payments in addition to improving their economic connections.

Beyond the financial sector, the benefits of this cooperation should be felt as the alliance grows, enhancing relations between Indonesia and the UAE for trade and investment. Both countries have a vision of economic integration and innovation, hence they are poised to be important participants in deciding the course of world financial cooperation.

The 36-year old Indian cricketer, Ravindra Jadeja has garnered the glory of becoming the No.1 all-rounder in the Test rankings…

On 14 May 2025, three artists Ken Miyake, Hiromitsu Kitayama and Yuma Jinguji from the TOBE agency has come forward…

China’s exports of steel to ASEAN countries had significantly sky-rocketed in Q1-2025, with an astounding 36.55 million tons traded within…

This June 2025 is going to be a historical moment for both the teams South Africa and Australia, who are…

Han So Hee is well known among the fans who follow the K-dramas ardently and she is recognised for her…

In a bid to strengthen its grip on the business, Singapore-based Frasers Property which is owned by Thai billionaire Charoen…

This website uses cookies.

Read More