Nestled within the lush embrace of nature, Malaysia, a veritable biodiversity haven, stands at the forefront of a transformative initiative aimed at nurturing its rich ecosystems and economic resilience. In a significant stride towards this endeavor, the Taskforce on Nature-related Financial Disclosures (TNFD) has introduced an innovative framework, illuminating the path for businesses operating within Malaysia to adapt and harmonize with the rhythms of nature.

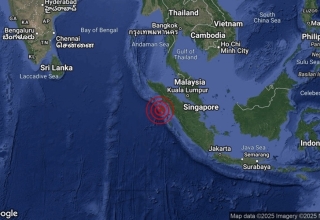

Despite occupying a mere 0.2 percent of the world’s landmass, Malaysia ranks as one of the globe’s most biodiverse regions per unit area, second only to Indonesia in Southeast Asia. This ecological wealth sustains numerous sectors, providing essential services such as fertile soils, pure water, vital pollination, and a climate that remains steadfast. These services underpin diverse segments of Malaysia’s economy, spanning agriculture, fisheries, forestry, construction, electricity generation, and water utilities.

Nature’s Ripple Effect on Finance

Yet, as the world grapples with environmental challenges, the disruption of these vital services presents a tangible threat to Malaysia’s financial landscape. A World Bank report paints a stark picture, suggesting that Malaysia could face an annual GDP loss of 6 percent by 2030 in the event of a partial ecosystem collapse. Such a scenario would involve a decline in select ecosystem services, particularly in sectors like forests, fisheries, and pollinators.

Moreover, a collaborative study by the World Bank and Bank Negara Malaysia (BNM) highlights the susceptibility of Malaysian banks to a spectrum of nature-related physical and transition risks. As of June 2023, Malaysian banks boast total assets amounting to RM 3,425 billion, with over half of their commercial loans portfolio linked to highly nature-dependent sectors. This exposure places these financial institutions at risk from the deterioration of ecosystem services, increasing vulnerability to transition risks arising from regulatory changes.

Corporate Concerns

Within this context, Malaysian corporations have begun to grapple with concerns that the erosion of natural ecosystems could destabilize operations directly or indirectly reliant on nature and its services. They recognize the need to align their practices with nature-related risks.

While Malaysian banks acknowledge nature-related risks in their client activities, there remains a challenge in integrating these risks into their policies effectively. Initiatives such as the No Deforestation, No Peat, and No Exploitation (NDPE) commitments, the avoidance of key biodiversity and protected areas, and the practice of water stewardship remain areas where greater alignment is needed.

Additionally, the business landscape is poised to confront a new wave of nature-related risk reporting standards. The Taskforce on Nature-related Financial Disclosures (TNFD) has introduced a comprehensive framework designed to assist companies in integrating nature into their business and investment activities. Much like its climate-focused counterpart, the Taskforce on Climate-related Financial Disclosures (TCFD), TNFD is anticipated to become the bedrock standard for reporting financially significant nature-related risks.

For logistics firms, the urgency to incorporate Environmental, Social, and Governance (ESG) practices into their operations is palpable. However, convincing internal stakeholders, particularly those not directly interfacing with clients or suppliers, can pose a challenge. Past studies have revealed that cost reduction remains a central focus of supply chain management strategies.

Nature’s Emerging Role

While businesses have made strides in assessing climate-related risks and integrating them into financing activities, the consideration of nature degradation and biodiversity loss in risk management frameworks is still in its infancy.

According to Katia Bonga of the World Business Council for Sustainability Development (WBCSD), a majority of companies in Southeast Asia are only beginning to embark on their nature-related journeys. The focus often remains centered on issues like climate change, energy, and circular economy initiatives. However, the ambition to address nature-related risks is undeniably present. In 2022, 40 percent of WBCSD’s Asia Pacific members expanded both the scope and ambition of their nature-related goals.

Measuring the impact of nature loss remains a multifaceted challenge, distinct from the standardized metrics for greenhouse gas emissions. While climate change can be quantified in terms of carbon dioxide equivalents and is governed by a global warming limit set by the Paris Agreement, nature loss lacks a singular unit of comparison.

Unlike greenhouse gas emissions, which contribute uniformly to global warming, the impact of nature-related factors can significantly vary based on location. Spatial data becomes fundamental for assessing a company’s nature-related impacts, risks, and opportunities, especially considering the variance in nature-related impacts across regions.

Keep Reading

Bridging the Data Divide

Challenges persist in accessing quality data on the state of nature. Standardized and comparable data sets on metrics such as soil health, primary forest extent, and eutrophication remain elusive across all countries.

Initiatives such as Trase, utilizing alternative data sources to map out supply chains, and open-source satellite data like EU Copernicus satellite data, aim to bridge the data gap surrounding the state of nature.

Navigating Nature’s Complexity

Building on the Nature-related Data Catalyst initiative initiated in July 2022, TNFD has introduced an online catalog of data and analytics providers to assist companies in their internal assessments of nature-related risks and opportunities. The LEAP (Locate, Evaluate, Assess, Prepare) approach offers a systematic process for organizations to identify interactions with nature, assess impacts and dependencies, evaluate risks and opportunities, and ultimately prepare to manage and report on material risks.

As Malaysia and businesses worldwide engage with the complex challenge of nature-related financial disclosures, these concerted efforts underscore the growing recognition of the inseparable link between a thriving economy and a flourishing natural world. Balancing the two becomes not just a matter of responsibility but a necessity for long-term sustainability.