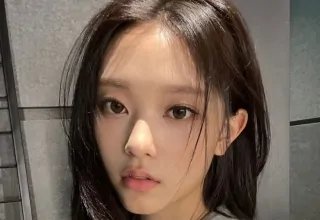

![]() MANILA: 22-year-old Chin Ching Peng had to make a choice between her dream career as a copywriter and a new field that would give her more money to support her family.

MANILA: 22-year-old Chin Ching Peng had to make a choice between her dream career as a copywriter and a new field that would give her more money to support her family.

According to her account of her job search in February, “most jobs (as a copywriter) offered salaries of S$2,500 or S$2,800… the only one that paid more than S$3,000 was for a job requiring at least two years of experience.”

It was only early this month that Ms. Chin began working for another company in a different industry, a fact she chose not to share with the public. She now earns between S$3,000 and S$4,000 per month before taxes and before her CPF contributions.

A larger salary is critical for the NUS graduate, who contributes to the family budget and pays for her mother’s medical expenses. There are roughly S$1,400 worth of expenses each month, but she anticipates that to climb as inflation continues to rise.

It used to cost approximately S$200 a month for our groceries. Now it costs almost S$300, so we’ve had to make some cuts. According to her mother’s grocery bill, several veggies at the wet market had increased in price by 30 cents or 50 cents.

The bank will approach her when she has to start repaying a student loan of roughly S$20,000.

Related Posts

She works as a freelance copywriter to supplement her income, earning anything from S$200 to S$500 for each project she accepts. She intends to provide Chinese lessons on the weekends as well.

During her limited leisure time, Ms. Chin either stays at home or eats at restaurants that cost less than S$20.

“There are a lot of things I can’t buy because of inflation and taking on additional household chores since I graduated,” she remarked.

As the cost of living continues to climb, Ms. Chin is one of many young people under 35 who have had to cut back or change their lifestyles.

Young people, in particular, are believed to be affected by inflation because incomes often don’t keep pace with the rising cost of common necessities. Clothing and footwear, as well as high-priced electrical goods, are also common purchases for young people.

“This would likely be the first time adolescents below 35 years old encounter living costs climbing this high since the start of their working life,” said Maybank economist Lee Ju Ye.

The inflation beast is proving difficult to tame for some recent college grads who are just starting their next chapter in life.

Some people, like Ms Chin, have chosen to dip into their savings rather than reduce their spending or take on side hustles in order to supplement their retirement funds.

As inflation continues to rise, even those in their 30s, even those who are able to make ends meet, are feeling the effects of rising prices.

Mr. Ho advised young folks to save six to nine months’ worth of their monthly average costs before investing, so that they have money in reserve in the event of an emergency.

In terms of short-term investing options, he recommended Singapore Savings Bonds, Money Market Funds, and short-term endowment plans.

It’s like “learning any other life skill… start out gently and build confidence over time” for new investors, he said.