In the dimly lit corridors of international business, far from the glaring eyes of the world, Samsung and SK Hynix, South Korea‘s semiconductor giants, have embarked on a covert mission, channeling a staggering $52 billion into the depths of China. This clandestine endeavor threatens to alter the course of global geopolitics, with a battle taking place not on the battlefield but in the heart of the tech world.

US Export Controls: A Shadowy Threat

The United States, fearing China’s military potential, has escalated efforts to control the sale of advanced chips. Last October, the Biden administration imposed restrictions, casting a shadow of uncertainty over South Korea’s semiconductor empire. The clock is ticking on a one-year waiver granted to these companies, with an uncertain extension hanging in the balance.

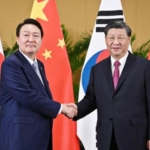

Amidst these secretive negotiations, President Yoon Suk-yeol warns that “geopolitical issues have become the biggest risk for companies.” In an undisclosed meeting of government officials and business executives, he likened the situation to an “all-out war” in the shadows, acknowledging that companies alone cannot navigate these treacherous waters.

China’s Silent Dominance

Semiconductors constitute a clandestine 20 percent of South Korea’s exports. Samsung and SK Hynix silently dominate the memory chip market, the unsung heroes of our digital lives. Their market shares, while publicly available, hide the depth of China’s influence. Over the past decade, more than half of South Korean chip exports went silently to China’s shores, creating a covert dependency.

Yang Hyang-ja, a former Samsung executive turned lawmaker, emerges as a rare voice in the shadows. She speaks of South Korea as a silent “victim” in the trade dispute. Her K-Chips Act, passed in secrecy, offers a lifeline to the beleaguered industry.

Keep Reading

The Hidden Factories in China

Samsung and SK Hynix operate hidden factories in China, producing NAND chips and DRAM chips. This covert presence presents a formidable challenge; withdrawing would be difficult, yet continued investment poses undisclosed risks. Avril Wu, a shadowy figure from TrendForce, warns of the unseen dangers lurking in this covert dance.

In the clandestine world of chip manufacturing, advances happen swiftly. Companies must invest covertly in equipment, parts, and research to remain competitive. Lim Hyung-kyu, a retired Samsung executive, whispers that extending the waiver by two to three years at a time would provide much-needed stability.

Regardless of the waiver’s outcome, the U.S. export controls could force Samsung and SK Hynix to adjust their covert strategies in China. Shifting their focus to serve Chinese customers exclusively or producing less advanced products in secrecy are among the discussed options.

The South Korean government, too, plays a covert hand in this global game. Plans to create a semiconductor “mega-cluster” signal a long-term commitment to domestic chip-making. Samsung’s pledge of $228 billion over the next two decades underscores the nation’s resolve.

In response to export controls and government incentives, more investments flow into the United States. Samsung commits $17 billion to a clandestine facility in Taylor, Texas, while SK Hynix earmarks $15 billion for a secret chip-packaging plant and research center. But South Korea walks a fine line, risking economic retaliation from China.

South Korea’s slow acceptance of President Biden’s semiconductor alliance, known as the “Chip 4,” reflects the nation’s hesitance. Yang Hyang-ja, the enigmatic lawmaker, believes that the U.S.-China tech rivalry will reshape the global supply chain for chip making, painting South Korea as a silent observer in a world of giants.