photo 37

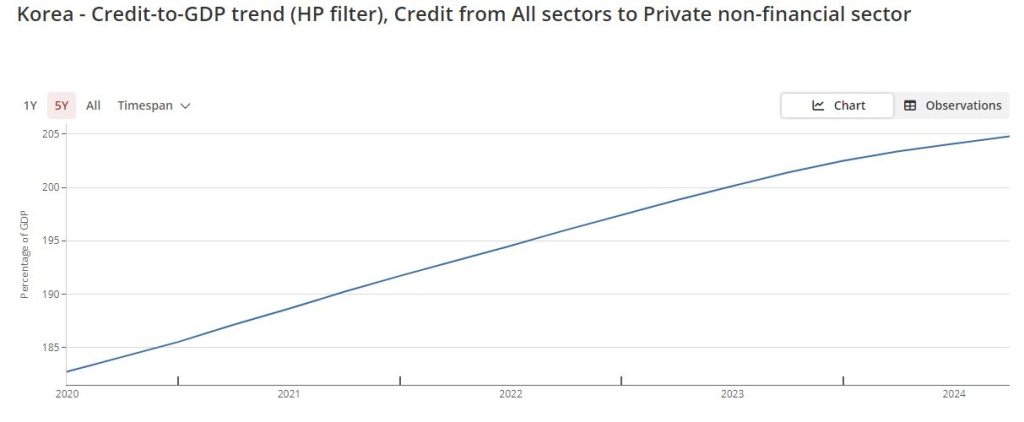

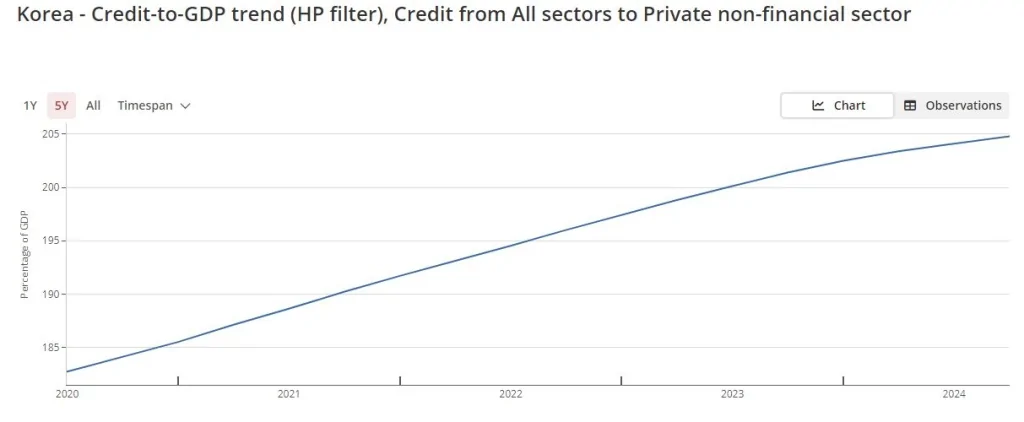

According to the most recent data produced by the Bank for International Settlements and released on Thursday, South Korea’s total debt- household, corporate, and government liabilities alike- grew by 4% within the third quarter of the past year, breaking its debt threshold past 6.2 quadrillion won ($4.24 trillion), which has now become 2.5 times the GDP of the country.

Thus, at the close of the third quarter, South Korea’s non-financial sector credit stood at 6,222 trillion won, an increase of 4.1% over the same period of the previous year and a rise of 0.9% over the last quarter of 2023.

The borrowings in the non-financial sector, commonly referred to as total debt, show the aggregation of borrowed amounts of households, enterprises, and governments excluding the financial sector. This measure is widely used by other countries around the world in their comparisons of countries’ debt levels.

South Korea first hit the 5,000 mark in early 2021 at the height of the economic troubles due to COVID-19. It has kept climbing all the way to close to the 6,000 mark by the end of the year.

Debt-wise, the increase notwithstanding, the overall debt-to-GDP ratio has kept on declining for South Korea. As of the third quarter of the previous year, the GDP was as high as 247.2%- the lowest ever since its peak in mid-2021. In the 252.9%, it peaked in mid-2023, it has now gone down in five consecutive quarters.

Corporates have reduced their debt-GDP by four quarters consecutively; this is now at 111.1%.

Household debt to GDP percentage reduced to 90.7%, the lowest since early 2020.

Second-highest household Debt Among Major Economies

Meanwhile, a different report from the Institute of International Finance released on Sunday stated that South Korea has one of the highest household debt-to-GDP ratios of any major economy towards the end of 2024.

Household debt as a proportion of GDP in South Korea hit 91.7%, making it second only to Canada, which topped the list with 100.6%. This measure is considerably higher than the average for emerging markets (46%) and the global average (60.3%).

As rising debt levels continue, concerns about financial stability remain a primary topic in the minds of policymakers and economic analysts in the country.

The Golden State Warriors were dealt a double whammy on a most disappointing April 2 during the NBA playoffs. This…

GE2025: More rallies will take place on April 24 by five parties. Public transport is a must. Singapore: Current scenes…

In a historic move, Malaysia has been the first nation to incorporate Formula One (F1) sourced data-logging technology into its…

The German food delivery service Delivery Hero plans to stop operating Foodpanda in Thailand as of May 23, 2025 after…

HORI has unveiled a collection of officially licensed accessories for the upcoming Nintendo Switch 2 which will release on June…

30-year-old Lucy Guo has now made it into the record books because she has been the youngest self-made woman billionaire…

This website uses cookies.

Read More