(C)politik

Last updated on May 7th, 2021 at 06:11 am

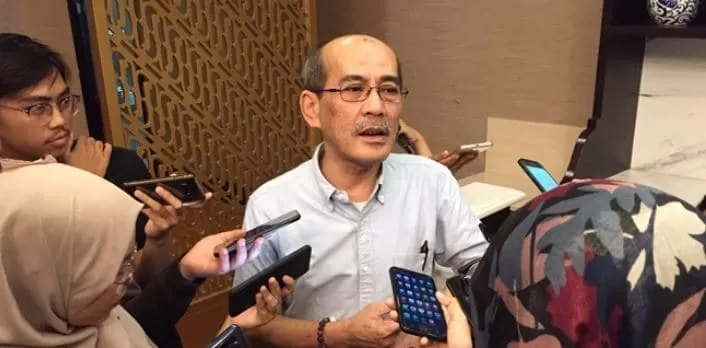

Senior Economist at the Institute for Development of Economics and Finance (Indef), Faisal Basri, assessed that Jiwasraya’s bailout was not the right way to deal with customer policy defaults, resulting in alleged corruption cases in this red plate insurance.

On that occasion, Faisal Basri precisely assessed that Jiwasraya Insurance was turned off.

“I think it’s better to turn it off, what can you do with it? Turn off, sell the assets, then the rest of the assets are transferred to some sort of PPA so that they don’t spread everywhere. It’s made healthy first, if the time is right for resale, the profits will be, the losses will be the minimum, “said Faisal at ITS Tower, South Jakarta, Friday (6/3).

On that basis, bailot to solve the Jiwasraya problem is not the right solution.

“There are total losses. Not all countries used to (pay). That’s called bail in, so shareholders first. The silent shareholder bailout, the silent regulator, the silence of the people who pay. That’s in my opinion a dzalim that case, “he said.

Faisal believes that the interests of customers are preferred. Large assets owned by Jiwasraya need to be sold immediately to provide customer losses.

Hong Kong billionaire Li Ka-shing sold Panamanian port terminals to a US-led group, causing diplomatic conflicts between Washington and Beijing…

In a major setback for Korea's burgeoning stars, a court in South Korea has ruled against NewJeans, disregarding their effort…

Malaysia Aviation Group (MAG) parent of Malaysia Airlines has set out to order 30 new Boeing 737 aircraft as part…

Indonesia and Vietnam have completed their long-negotiated and pending ratification of their maritime boundaries. While this will probably improve maritime…

Japan achieved historical first place in World Cup 2026 qualification after beating Bahrain 2-0 at Saitama Stadium. After bringing on…

Lawmakers across parties worry about the Trump administration's decision to stop funding the Open Technology Fund because leading Republicans view…

This website uses cookies.

Read More