Last year, the Japanese economy encountered a number of obstacles, including a record decline in the value of the yen versus the U.S. dollar and decades-high inflation.

However, efforts were also made to recommence economic activity halted by the COVID-19 epidemic, exemplified by the reopening of borders for the first time in two years.

According to economists, the forecast for the Japanese economy is relatively good, despite the fact that a succession of rate raise campaigns designed to restrain inflation are projected to cause major economies, including the U.S., to decline this year.

Price increases are anticipated to decelerate or even reverse, while the economic recovery from the health crisis is anticipated to accelerate due to robust domestic demand.

Looming Inflation

During the previous several months, a variety of commodities’ prices have increased due to the Russia-Ukraine conflict-induced increase in commodity costs and the historic decline of the yen, which in October fell below 150 per U.S. dollar for the first time since 1990.

In January of last year, core consumer prices excluding volatile fresh food increased by only 0.2% from the previous year. However, by November of last year, this figure had hit an almost 41-year high of 3.7%.

Nevertheless, the inflation rate will likely decline this year, as commodity prices are anticipated to decline and the yen is anticipated to appreciate as central banks abroad pull down the rate rises that defined their policies in 2022, according to some experts.

“The rate of inflation likely peaked in December or will do so in January.” After then, I anticipate a rapid decline, according to Hideki Matsumura, chief economist of the Japan Research Institute.

In contrast to what has occurred in the United States and Europe, the major causes pushing up prices in Japan are imported energy and food costs, so once these sources cool off, inflation will decline, he added.

Although the inflation rate is still relatively low in comparison to other nations, the price increases forced the government to enact a number of countermeasures, including gasoline subsidies and cash handouts for low-income people.

Beginning this month, the government will also give subsidies to limit the increase in energy and gas costs.

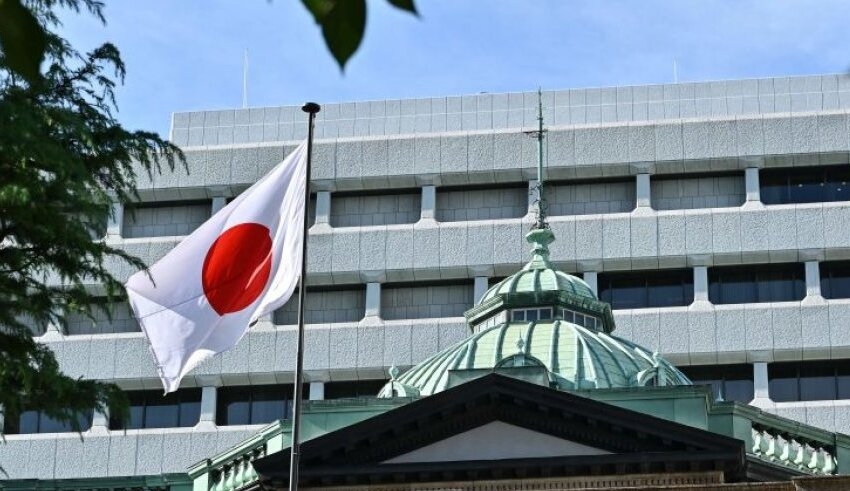

The Bank of Japan forecasted in its October quarterly report that the inflation rate for fiscal year 2023 will be 1.6%.

Keep Reading

Wage Hikes

During the previous several months, a variety of commodities’ prices have increased due to the Russia-Ukraine conflict-induced increase in commodity costs and the historic decline of the yen, which in October fell below 150 per U.S. dollar for the first time since 1990.

In January of last year, core consumer prices excluding volatile fresh food increased by only 0.2% from the previous year. However, by November of last year, this figure had hit an almost 41-year high of 3.7%.

Nevertheless, the inflation rate will likely decline this year, as commodity prices are anticipated to decline and the yen is anticipated to appreciate as central banks abroad pull down the rate rises that defined their policies in 2022, according to some experts.

In contrast to what has occurred in the United States and Europe, the major causes pushing up prices in Japan are imported energy and food costs, so once these sources cool off, inflation will decline, he added.

Although the inflation rate is still relatively low in comparison to other nations, the price increases forced the government to enact a number of countermeasures, including gasoline subsidies and cash handouts for low-income people.

Beginning this month, the government will also give subsidies to limit the increase in energy and gas costs.

The Bank of Japan forecasted in its October quarterly report that the inflation rate for fiscal year 2023 will be 1.6%.

Heightened Domestic Demand

With decelerating inflation and accelerating wage growth, consumers’ surplus savings during the epidemic will contribute to the recovery of domestic consumption.

In September of last year, householders had accumulated around 55 trillion in surplus savings, according to a research by the Daiwa Institute of Research on the future for the Japanese economy.

According to the research tank, a prolonged travel discount program set to begin this month would likely boost consumption and have an economic effect of 1.6 trillion.

Aoki said that there is still ample potential for the service industry to expand, since travel demand among young people has greatly rebounded, but demand among the elderly and families with young children remains sluggish.

Alongside healthy consumer spending, businesses are anticipated to increase their capital expenditures.

According to the quarterly tankan report released by the Bank of Japan last month, projected capital investments for the fiscal year ending in March rose 15.1% year over year, the largest increase for a December survey since 1989.

“Companies abstained from making investments during the epidemic, so there is just pent-up demand,” said Aoki, adding that many companies are eager to invest in labor-saving measures or productivity enhancements because to labor shortages.

Since Japan eased its border restrictions and started visa-free travel in October, inbound tourism is also expected to play a major role in the economic rebound.

In November, the number of international visitors increased to 934,500, nearly double the amount reported in October and approaching 40% of the November 2019 level.

Although the yen will likely recoup some strength this year, the currency will likely stay weak overall, which might attract more foreign tourists.

Matsumura stated, “I believe international tourists will spend more, thus inbound tourism will be the biggest driving factor (for the Japanese economy).”